Employer Webinar Series

Understanding the Wage and Hour Laws

Tuesday, July 8, 2014

2:00 p.m. ET / 11:00 a.m. PT

Understanding the Wage and Hour Laws

Tuesday, July 8, 2014

2:00 p.m. ET / 11:00 a.m. PT

Author Stanley Gordon West said, “Smile and the world smiles with you.” He may have been onto something. There used to be a time when most working Americans took dental care for granted. Of course, times change and so has our nation’s health care. The Patient Protection and Affordable Care Act (PPACA) doesn’t mandate dental coverage for adults, but voluntary dental coverage has become increasingly competitive based on research from Eastbridge.

The Patient-Centered Outcomes Research Institute (PCORI) fee is due July 31, 2014, for virtually all group medical plans.

The Patient-Centered Outcomes Research Institute (PCORI) fee is due July 31, 2014, for virtually all group medical plans.

Who is responsible for this fee?

The carrier is responsible for paying the fee on insured policies, and the employer/plan sponsor is responsible for paying the fee on self-funded plans [including Health Reimbursement Arrangements (HRAs)]. IRS Form 720 is used to report and pay the fee.

What is PCORI?

PPACA created a private, non-profit corporation called the Patient-Centered Outcomes Research Institute (PCORI). The Institute’s job is to research the comparative effectiveness of different types of treatment for certain diseases, and to share its findings with the public and the medical community. The goal is to improve quality of treatment and reduce unnecessary spending. The fee is to support this research.

The PCORI fee applies from 2012 to 2019. The fee is due based on plan/policy years ending on or after October 1, 2012, and before October 1, 2019. The fee is due by July 31 of the year following the calendar year in which the plan/policy year ended. This means that the first fee was due July 31, 2013, for those on November, December, and calendar year plan years. The first fee is not due until July 31, 2014, for those with plan years that start January 2 through October 1.

Get the latest information on fee start and end dates, calculation methods, reporting rules and more with UBA’s recently updated PCORI resources, including:

1. Highlights of the PCORI Fee. For those interested in a condensed explanation of the PCORI fee, this document includes:

Download the free highlights now.

2. Frequently Asked Questions (FAQ) about the PCORI Fee

3. Comparison Chart of PCORI and TRF. Many employers are gearing up to comply with the new fees under the Patient Protection and Affordable Care Act (PPACA). UBA offers a comparison of the PCORI fee and the Transitional Reinsurance Fee (TRF) that gives a side-by-side comparison of each, including start and end dates, reporting methods, fee due dates, exclusions, calculation methods and more.

Request the PCORI and TRF Comparison Chart now.

For further information, please contact a UBA Partner Firm near you.

By Josie Martinez, Senior Partner and General Counsel

By Josie Martinez, Senior Partner and General Counsel

EBS Capstone

As of January 1, 2014, the Patient Protection and Affordable Care Act (PPACA) requires pediatric dental benefits to be one of the 10 essential health benefits (EHB) that must be included in individual and small group medical coverage, as well as coverage offered through the Exchanges.

The EHB dental benefit applies to children ages 0-18. It is estimated that as many as 5.3 million additional children will receive dental coverage as a result of PPACA. The services covered may include preventive and diagnostic services, basic and major restorative services. It also applies to “medically necessary” orthodontic services. Since “medically necessary” is subject to interpretation, prior authorization is recommended as there are pre-treatment requirements. The expectation is that pediatric dental procedures covered will be fairly similar to those covered today under separate commercial plans. Specific coverage provisions, however, are a state-by-state determination because each state has its own EHB packages [obviously guided by the Department of Health and Human Services (HHS)]. Therefore, a state could choose to only cover semi-annual preventative visits with x-rays and sealants. Some states will include orthodontia; others may not.

Historically, the vast majority of dental benefits have been sold under a dental policy separate from medical. At a federally run Exchange, consumers will continue to have the option to purchase stand-alone dental coverage for themselves and dependents over 18. However, under the new rules outside the Exchanges, ALL medical policies offered to consumers in the individual and small group markets MUST include pediatric dental benefits.

Employers and employees that have pre-existing medical and dental insurance plans are finding this confusing… there may be duplication of dental coverage for children under 18 as of 2014 for employees that have both stand-alone dental coverage and medical coverage.

Which coverage applies? Who is covered? When should I use my dental plan? In most cases, the medical plan coverage will be primary to any additional dental policy that applies. So, when a child under 18 visits the dentist now, the employee should be directed to show the medical plan ID card in addition to any dental plan coverage. If the medical plan includes pediatric dental coverage, the member may not need to take any additional action to process the claim.

To avoid duplication of premiums, employees can drop their children from their separate dental plans. However, before doing so, they should be advised to consider 1) the network of dentists and 2) the scope of services. Depending on the network size and scope of services provided by the medical plan, employees may want to keep supplemental dental coverage to ensure more comprehensive benefits.

The adage, “If it ain’t broke, don’t fix it,” doesn’t apply to Generation X and Y — at least not when it comes to employers and their use of the latest technology. As employers build relationships with their current employees and potential recruits, they need to be aware that these people are sizing them up for their use, or lack thereof, of the most recent technology. Furthermore, these same employees are not afraid to quickly leave for someone else if they feel an employer is out of touch regardless of their previous track record.

1. What must I do to avoid the employer taxes?

1. What must I do to avoid the employer taxes?

Beginning in 2015, if you average enough full-time employees or full-time employee equivalents during a calendar year to be considered an “applicable large employer,” to avoid the shared-responsibility penalty you must provide medical coverage that:

2. What is an “applicable large employer?”

An “applicable large employer” (large employer) is an employer that had a certain number of full-time and full-time equivalent employees during the prior calendar year. For 2015, a large employer is an employer that has 100 or more full-time or full-time equivalent employees in 2014. An employer with 50 to 99 employees also will be considered large for 2015 if it does not meet coverage maintenance requirements. For 2016 and later, a large employer is an employer that had 50 or more full-time or full-time equivalent employees during the prior calendar year.

3. How do I know if I have 100 or 50 full-time or full-time equivalent employees?

An employee is counted as a full-time employee if the employee was employed an average of 30 hours per week during the prior calendar year.

An employee counts toward a full-time equivalent employee if the employee worked an average of less than 30 hours per week during a calendar month. To calculate the number of full-time equivalent employees for a month, the hours of all full-time equivalent employees are totaled and then divided by 120.

EXAMPLE: During January, Company A has 30 employees who average 40 hours per week, 19 employees who average 30 hours per week, 1 employee who worked 60 hours during the entire month, and 1 employee who worked 82 hours during the month.

Company A has 49 full-time employees [30 + 19] and 1.2 full-time equivalent employees [(60 + 82) ÷ 120 = 1.18]. Therefore, Company A has 50 employees for that month for purposes of the penalty.

Note: There are special rules for employers with seasonal employees. Employers in a controlled group, or affiliated service group, are combined when deciding how many employees they have.

4. Who is an “employee”?

The Patient Protection and Affordable Care Act (PPACA) says that “common law” employees are the workers covered by the law.

5. Do I have to cover dependents?

Employers need to offer coverage to children up to age 26 by 2016 to avoid penalties for not offering coverage. Employers do not have to offer coverage to spouses.

For further information about the health care reform requirements for your business, download UBA’s complimentary guide, “PPACA Compliance and Decision Guide for Small and Large Employers” from the PPACA Resource Center at http://bit.ly/1nHbaWv.

A young employee just starting out in the workforce may be tempted to think that he or she will stay at the same company for decades until retirement with a congratulatory party and gold watch in recognition of their years of dedication. The reality, however, is that “job hopping” has become the new normal.

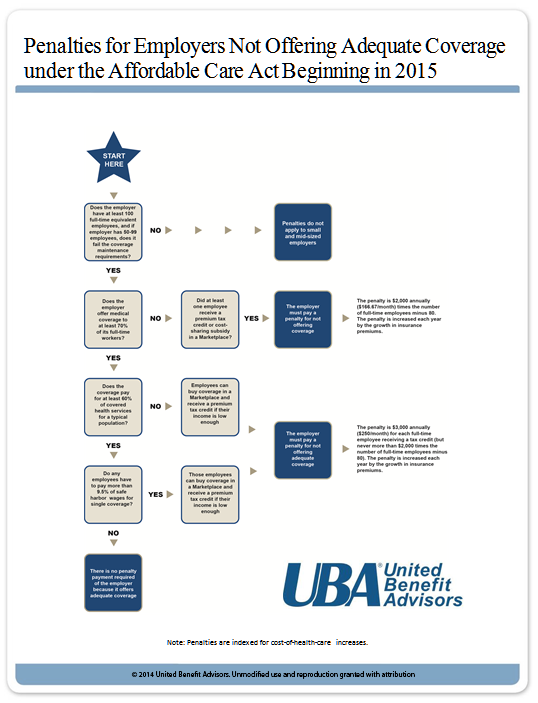

PPACA Symptom Checker Diagnoses Your Penalty Prognosis

Understanding the penalties for not offering adequate coverage under the Patient Protection and Affordable Care Act (PPACA) is tricky for many employers. Use UBA’s chart below to see if your company will have to pay a penalty. For further information about the health care reform requirements for your business, download UBA’s complimentary guide, “PPACA Compliance and Decision Guide for Small and Large Employers” from the PPACA Resource Center at http://bit.ly/1nHbaWv. If you are not sure if you are a large or small employer under PPACA, request UBA’s Counting Employees Under PPACA.

Sponsored by The Principal, in this webinar we’ll discuss how simple plan design changes can help your participants better prepare for retirement — and positively impact your organization’s bottom line.