The FMLA Freight Train: How To Stay Ahead of It

Wisdom Workplace Webinar: The FMLA Freight Train: How To Stay Ahead of It

Monday, October 27, 2014

11:00 a.m. ET / 8:00 a.m. PT

Wisdom Workplace Webinar: The FMLA Freight Train: How To Stay Ahead of It

Monday, October 27, 2014

11:00 a.m. ET / 8:00 a.m. PT

By Linda Rowings

By Linda Rowings

Chief Compliance Officer, UBA

The U.S. Department of Health and Human Services (HHS), the Internal Revenue Service (IRS), and the Department of Labor (DOL) released final regulations that explain when dental and vision plans and employee assistance plans (EAPs) will be considered “excepted benefits.” Excepted benefits are health benefits that are limited enough in scope to be exempt from many of the requirements of the Patient Protection and Affordable Care Act (PPACA), such as annual dollar limits, reporting on W-2s and various fees.

Excepted benefits are not considered “minimum essential” coverage. This means that a large employer will not avoid the employer-shared responsibility (play or pay) penalty if it simply offers coverage that is considered an excepted benefit. It also means that an individual who is covered by an excepted benefit remains eligible for a premium tax credit, as long as the person meets the income and other requirements to receive the credit.

The regulatory agencies issued proposed regulations in December 2013 and the final regulations generally follow the proposed regulations, although in a few instances the final rule is less restrictive than the proposed rule. The proposed regulations also addressed a new type of benefit called a “limited wraparound” plan; the agencies will issue a final regulation on this benefit later.

Dental and vision benefit plans are considered excepted benefits if the benefits offered are limited to care of the mouth or eyes and the benefits either are provided under a separate policy or they are not an “integral” part of the medical plan. Under the final rules, benefits are not considered an integral part of a plan if participants have the right to opt out of coverage, or if claims are administered under a separate contract from other benefits administration. To qualify as a non-integrated benefit, employees do not have to pay a separate premium or contribution for the excepted coverage.

Particularly for self-funded plans, the new rules will make it much simpler for a stand-alone dental or vision plan to qualify as an excepted benefit. A benefit will be considered an “excepted benefit” if it meets any of these criteria:

For more information on excepted benefits, including how to determine the status of EAPs, download UBA’s PPACA Advisor, “Excepted Benefits – ‘Limited Scope’ Dental and Vision Plans and EAPs.”

Saturday, October 25, 2014 at 10 am Soldier Field Stadium Green 1410 S Museum Campus Drive, Chicago, IL Making Strides Against Breast Cancer is a celebration of survivorship an occasion to express hope and our shared determination to make this breast cancer’s last century. The fight to end breast cancer starts with a single step. … Continued

By Elizabeth Kay

By Elizabeth Kay

Compliance and Retention Analyst

AEIS, a UBA Partner Firm

Health care reform has brought about many changes and growing pains. One of the changes we have seen recently in 2014 is the increased use of focused or ”narrow” provider networks. While these were implemented by the insurance carriers in the individual Marketplace to help control premium costs, we have seen the subscribers of employer sponsored or group plans affected as well, but it’s not in the way you might think.

Just before 2014, we talked with our clients, who are also providers, and informed them about the smaller networks ahead of time. This is so they could check with their carriers to confirm if they were going to be considered participating providers in the smaller networks to help avoid confusion, as many of them were not even aware that carriers had more than one HMO or PPO network that they offered.

Later in 2014, we started receiving phone calls from some of our other clients and their employees complaining that they were unable to get in to see their doctors. They were being denied access to the same providers that they had been seeing for years, with their same insurance coverage, due to the provider citing that they no longer accepted their insurance carrier.

Now, according to the insurance carrier, their providers were still contracted in-network providers, so why would they decline to accept their insurance?

Well, it turns out that the provider had seen some patients that had coverage with a carrier with whom they were contracted. However, upon submitting the claims to the carrier, the claims were not paid by the carrier because the insured had been issued coverage through our state Marketplace exchange with access to a narrow network, not the full carrier network.

To make matters more complicated, this particular carrier had used the same prefix and numbering system for the subscriber numbers of enrollees from the individual state Marketplace plans and enrollees in employer sponsored or group plans.

Therefore, when the provider submitted claims for those enrolled through their employer, those claims were being declined by the carrier, even though they should have been accepted and paid. But, because the subscriber numbers looked the same as those of individual enrollees, the claims system rejected them as it was coded to process claims based on the subscriber number, and not by another factor such as a group number.

As a result, the provider began denying any patients that had coverage through this carrier because they were not getting paid, and thought that their contract had been suspended or terminated.

After we had gone back and forth between the provider and the carrier, we finally discovered what the problem was, and they fixed the problem.

Once they were able to correct it, those provider’s claims that should be paid because they had coverage through an employer sponsored plan would be covered, as they had access to the full provider network. But providers were not really educated about any of this, so they were still denying patients.

We contacted the providers on behalf of our clients that had reached out to us with this problem and were able to educate them. We asked that they re-submit the claims for our clients. One billing specialist was in some disbelief, but we told her that we had confirmed with the carrier that the claims for our client would be paid, explained why the claims were declined in the first place, and finally convinced her to complete the re-submission process not only for our client, but for others that had been declined as well. We then took an additional step and told them the proper questions to ask their patients about what kind of coverage they have so that they can avoid having claims declined in the future.

So, I suppose the moral of the story is to educate, be informed, and be aware that even if you don’t have a plan with a narrow or skinny provider network, you can still be impacted. But as long as we keep calm, stick together, and have knowledgeable advisors to rely on, then we will be able to overcome these growing pains together.

Bring it on, 2015, we are ready for you!

To benchmark your plan design and costs with other employers of your size, geography and industry, request a custom benchmarking report from your local UBA Partner firm.

By Carol Taylor, Employee Benefit Advisor

By Carol Taylor, Employee Benefit Advisor

D&S Agency, A UBA Partner Firm

There is a lot of buzz in the market right now as employers are implementing their plans for the upcoming year. Many employers are looking at ways to keep their costs for medical coverage low, but still meet the requirements of the Patient Protection and Affordable Care Act (PPACA). These plans, often referred to as ”skinny plans,” may only cover preventive services or may cover everything but inpatient or outpatient hospital services.

Since these plans will meet the minimum essential coverage requirement, as long as they are employer sponsored plans, they will allow employers to not be penalized under the “A” fine of $2,000 per employee less the first 30.

However, the lingering question remains about whether they meet minimum value. The plan that only covers preventive services definitely does not meet minimum value, even based on the calculator released by the Department of Health and Human Services (HHS). It returns a minimum value calculation of less than 12%, far below the required 60%.

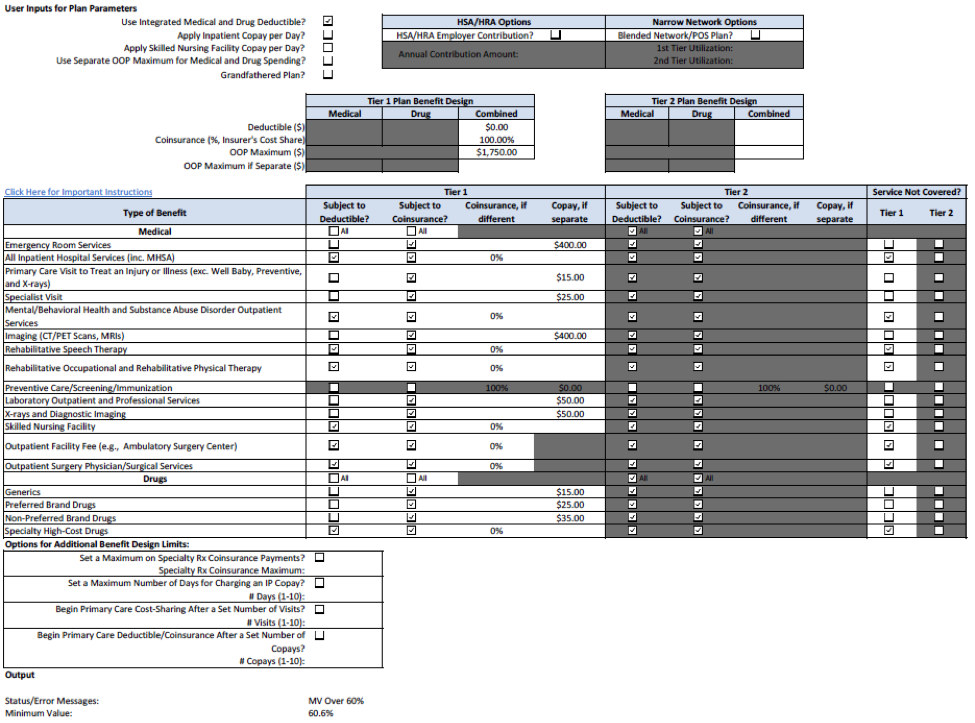

There seems to be much confusion though, with plans that do not cover inpatient hospitalization services. If you are only basing their value on the HHS minimum value calculator, they barely pass with a 60.6% value, as seen below in Picture 1. However, the Internal Revenue Service (IRS), who is tasked with enforcing the employer fines, has stated in IRS Notice 2012-31 that plans that do not cover the four core categories of coverage “would not satisfy any of the design-based safe harbors.” The four core categories they reference include physician and mid-level practitioner care, hospital and emergency room services, pharmacy benefits, and laboratory and imaging services.

Is it possible that there are technical issues with the HHS minimum value calculator? Quite likely. The first version of the calculator that was released did not calculate properly unless you ran the plan through a second time.

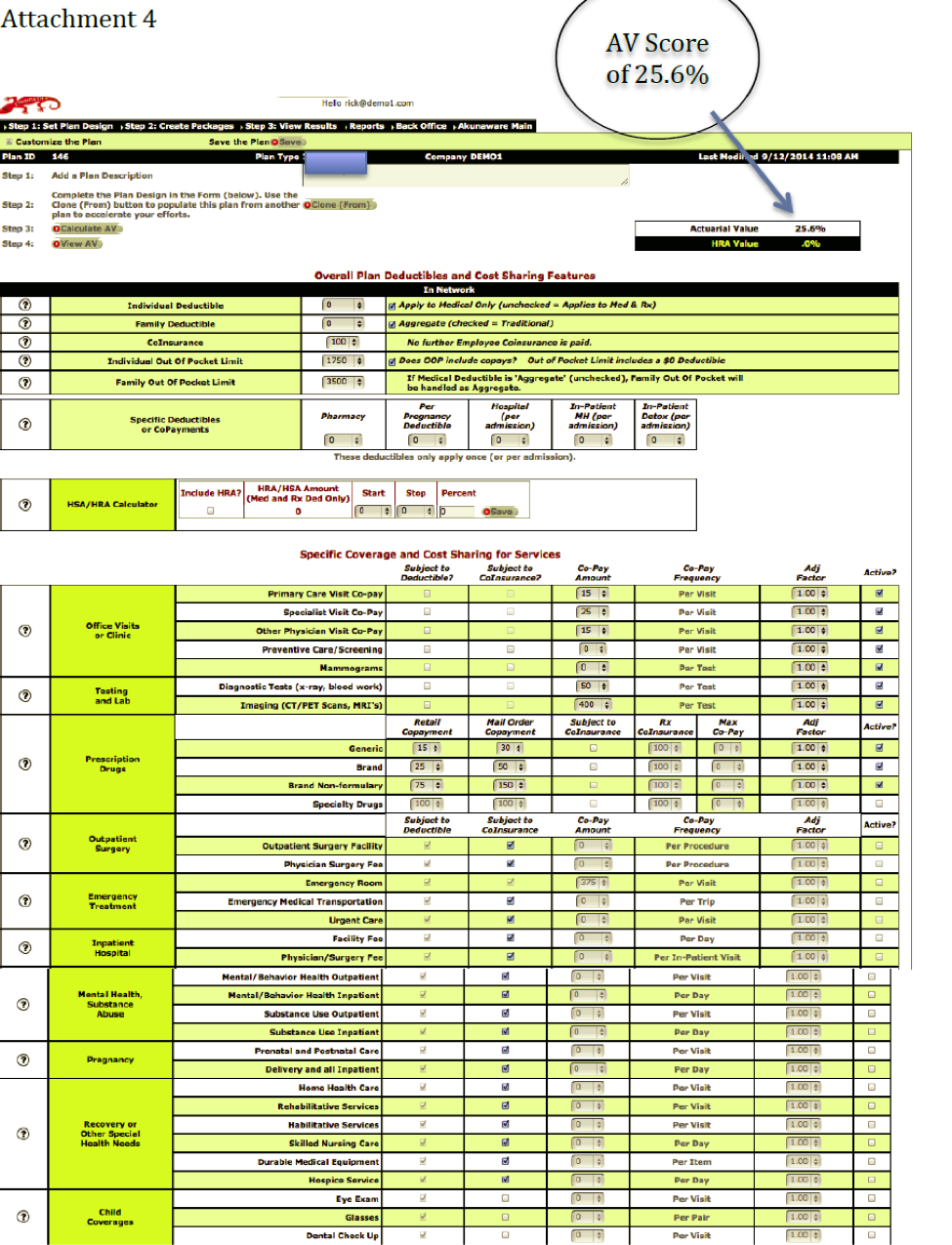

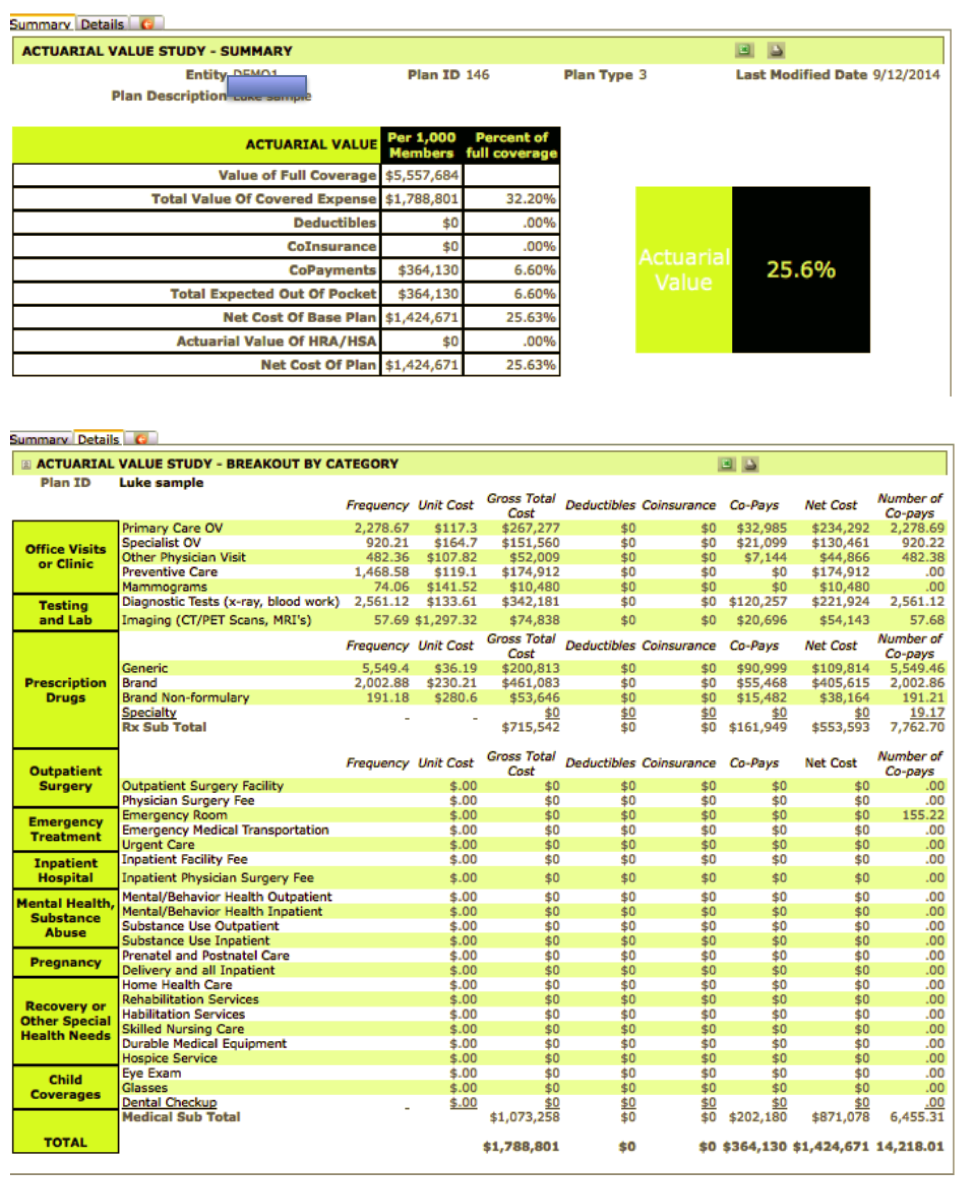

Actuaries believe that the skinny plans don’t pass the minimum value test. Using ClearPATH, a commercial grade actuarial value calculator developed by actuary Richard Burd, the same plan that passes the HHS calculator, fails the minimum value score with a mere 25.6% value. Pictures 2 and 3 show the details, using the same benefit design as shown in the HHS calculator. The ClearPATH input screen follows the benefits as outlined in a summary of benefits and coverages (SBC), with total transparency on cost assumptions, and is available from Contribution Health, in Lancaster, PA, or their software partner, Total Compensation Systems. It is interesting to note that other actuary models also place the value of these plans in the same range as ClearPATH.

Employers should approach these plans with extreme caution. Since the IRS is the agency that will levy the fines for those employers with more than 50 full-time equivalent employees that do not offer affordable, minimum value coverage, their own regulatory guidance should bear more weight.

Employers also should keep in mind they could be opening up potential liability for lawsuits under the Employee Retirement Income Security Act (ERISA). If HHS were to change, or in some views correct, their system, the employees would have made decisions based on not having all the correct information. They would have relied on their employer to supply them with that. If the employer did not perform their due diligence, not only would they be opening the door for potential lawsuits from employees, but IRS fines would also be levied. Unless the IRS also released transitional relief, these changes could occur in the middle of a plan year. With mandatory 60-day advance notice requirements of off-renewal changes, this could prove quite costly for an employer.

If faced with making that decision now, employers should always err on the side of caution.

Image 1:

Image 2:

Image 3:

Below are some to-dos for sponsors of self-funded group health plans. The information is limited generally to the “what” and the “when.” For more details on each of the items, request UBA’s PPACA Decision Guide for Self-funded Plans.

Below are some to-dos for sponsors of self-funded group health plans. The information is limited generally to the “what” and the “when.” For more details on each of the items, request UBA’s PPACA Decision Guide for Self-funded Plans.

1. HIPAA Risk Assessment & Training

A self-funded group health plan is a covered entity under the Health Insurance Portability and Accountability Act (HIPAA). The HIPAA Privacy and Security Rules provide a baseline of protections for use and disclosure of individually identifiable health information held by covered entities and their business associates. The Privacy Rule gives individuals rights regarding that information; the Security Rule specifies administrative, technical, and physical safeguards for covered entities and their business associates. Employers sponsoring self-funded group health plans should, at a minimum, conduct and document a HIPAA Risk Assessment and train employees on the procedures and protocols that the company has in place to address the findings of the HIPAA assessment.

Employers should also review their state laws. Some states have more stringent requirements. For example, Texas law requires employees of covered entities to have HIPAA training within 30 days of employment and then ongoing training every two years.

2. Update the Plan’s BAAs

Plan sponsors of self-funded group health plans need to be sure their business associate agreements (BAAs) have been amended to meet the requirements of the Health Information Technology for Economic and Clinical Health (HITECH) Act by September 22, 2014. A “business associate” is a person or entity who performs functions or activities on behalf of, or provides certain services to, a covered entity that involve access by the business associate to protected health information and includes subcontractors that create, receive, maintain, or transmit protected health information on behalf of another business associate.

Sponsors should verify that a compliant BAA is in place between the plan and the plan’s TPA, broker, and other vendors which meet the definition of business associate.

For more information, go to HHS Guidance for BAAs.

3. Apply for the Plan’s HPID

The Patient Protection and Affordable Care Act (PPACA) and HIPAA require that self-funded health plans obtain and use a 10-digit health plan identifier (HPID) in certain transactions. The purposes of requiring HPIDs include:

The HPID must be used by health plans, or their business associates, when conducting electronic “standard transactions” beginning November 7, 2016. Large health plans [GM1] must obtain an HPID by November 5, 2014. For this requirement, a large health plan is one with more than $5 million in claims paid for the prior plan year. Small health plans [GM2] have until November 5, 2015, to obtain an HPID. A small health plan is one with less than $5 million in claims paid for the prior plan year.

Please Note: The plan’s TPA may not obtain the HPID for the plan.

4. Filing and Payment of Transitional Reinsurance Fee

PPACA established the transitional reinsurance fee (TRF). The funds generated by the TRF will help stabilize premiums in the individual insurance market. The TRF applies to self-funded major medical plans for 2014, 2015, and 2016. (Insurers pay the fee on fully insured medical plans.)

Plan sponsors of self-funded plans must report the number of covered lives and pay the fee to the federal government at www.pay.gov. The filing of the number of covered lives is due by November 15, 2014. While the form is not yet available, sponsors should [GM3] decide which is the most beneficial method for determining the number of covered lives. The plan’s TPA may assist with the calculation and pay the applicable fee on behalf of the plan sponsor.

Plan sponsors may pay the fee in one installment, by January 15, 2015, January 15, 2016, and January 15, 2017, or in two installments each year. If paid in installments, the larger installment will be due January 15 and the smaller installment will be due November 15. For example, if the 2014 fee is paid in installments, $52.50 per person will be due January 15, 2015, and $10.50 per person will be due November 15, 2015.

5. 6055 & 6056 Reporting

Beginning in 2016, carriers, self-funded employers, ALEs, and individuals will be responsible for reporting coverage information based on the 2015 plan year. In order for the IRS to verify that individuals and employers are meeting their shared responsibility obligations, and that individuals who request premium tax credits are entitled to them, employers and insurers will be required to provide reporting on the health coverage they offer.

All applicable large employers will complete Part I and Part II of IRS Form 1095-C for each employee, regardless of whether the employee was eligible for coverage during the reported year. Self-funded ALEs will complete Part III – covered individuals. Part III requires the employer to report for each covered individual the covered individual’s name, social security number (SSN), and date of birth if the SSN is unavailable.

The reporting will occur with the same timing and process as W-2 and W-3 reporting. Even though these forms are not final, employers may want to study them as they begin to determine whether they are currently collecting, and will be able to retrieve, the information needed to complete the forms.

[GM1]Personally, I would remove the underline as this tends to indicate in a blog that text is hyperlinked.

[GM2]Same for this underlined text.

[GM3]There’s nothing wrong with this word other than it’s used twice in the same sentence.

On September 18, 2014, the Internal Revenue Service (IRS) issued Notice 2014-55 which allows employers to amend their Section 125 plans to recognize several new change in status events.

On September 18, 2014, the Internal Revenue Service (IRS) issued Notice 2014-55 which allows employers to amend their Section 125 plans to recognize several new change in status events.

Open Enrollment in the Health Insurance Marketplace

Prior to this new notice, an opportunity to enroll in the health insurance Marketplace (or “exchange”) was not considered a change in status event. This made it difficult for employees in non-calendar year plans to move between a group health plan and the Marketplace since Marketplace coverage generally operates on a calendar year.

Effective immediately, an employer may treat open enrollment for Marketplace coverage as a change in status event, and allow an employee and other covered dependents to drop group medical coverage mid-year to enroll in a Marketplace plan. Marketplace coverage must begin on the day after coverage under the employer’s plan ends.

This change in coverage under the employer’s plan may only relate to dropping medical coverage — an employee may not change his or her health flexible spending account (HFSA) contributions, dental coverage, or vision coverage because Marketplace coverage is being elected. The employer may rely on the employee’s statement that the individuals dropping coverage are moving to Marketplace coverage — the employer does not need to obtain proof that Marketplace coverage was put into place.

Special Enrollment in the Health Insurance Marketplace

Prior to this notice, special enrollment in the health insurance Marketplace was not considered a change in status event. This meant that an employee who experienced a special enrollment event (such as marriage, birth, or adoption) might be able to enroll the new family member in Marketplace coverage mid-year but could not move other family members to Marketplace coverage. Effective immediately, an employer may treat special enrollment in Marketplace coverage as a change in status event, and allow an employee and other covered dependents to drop group medical coverage mid-year to enroll in a Marketplace plan. Marketplace coverage must begin on the day after coverage under the employer’s plan ends.

This change may only relate to dropping medical coverage — an employee may not change his or her HFSA contributions, dental coverage, or vision coverage because Marketplace coverage is being elected.

The employer may rely on the employee’s statement that the individuals dropping coverage are moving to Marketplace coverage — the employer does not need to obtain proof that Marketplace coverage was put into place.

Revocation Due to Reduction in Hours of Service

The third new permitted change in status event is designed to address issues that may arise if the employer chooses to measure hours using the lookback (measurement and stability periods) method of determining hours for purposes of meeting the employer-shared responsibility requirements. In this situation, to avoid employer-shared responsibility penalties, the employer must offer the employee coverage throughout the following stability period if the employee averaged 30 or more hours per week during the measurement period, even if the employee’s hours are reduced below 30 hours per week. Maintaining the same coverage despite lower income may cause a financial hardship to the employee.

Under the new change in status event, if the employee remains eligible for group medical coverage, even though he or she is now working fewer than 30 hours per week, the employee may revoke the group medical coverage election mid-year to enroll himself or herself (and any covered dependents) in either Marketplace or other employer-provided coverage. The employee may not discontinue all medical coverage, and the new coverage must provide minimum essential coverage. The employee may not change any election of dental or vision coverage or any HFSA election. The new coverage must be effective no later than the first day of the second month following the month that includes the date the original coverage is discontinued.

The employer may rely on the employee’s statement that the individuals dropping coverage are moving to Marketplace or other minimum essential coverage — the employer does not need to obtain proof that this coverage was put into place.

An employer may choose to add any, all or none of these new change in status events under its Section 125 plan. The Section 125 plan must be amended to include any new change in status event by the end of the 2015 plan year.

An employer that chooses to recognize the new change in status events may begin administering its plan to include them immediately. This means, for example, that a non-calendar year plan could allow employees to discontinue employer-provided coverage and enroll in the Marketplace for 2015. Keep in mind that while the employee and dependents may enroll in Marketplace coverage, a premium tax credit will not be available while the person remains eligible for minimum value, affordable (based on the cost of self-only) coverage offered by the employer.

If the employer chooses to include any new change in status events, that decision should be communicated to employees promptly, even though the actual plan amendment is not needed immediately.

For more information about PPACA provisions and how they impact your group health plan, request UBA’s decision guides.

If you’ve ever taken a cardiopulmonary resuscitation (CPR) course, then you know how critical response time is to saving the life of the person in distress. According to an article by the Society for Human Resource Management (SHRM.org), several studie…

By Stacey Anderson Compared to women, men tend to drink more, suffer more from stress and seek medical advice less often. However, men are also living longer and their lifespan is catching up to women. Make sure that your later years are as healthy as possible. As you age past 40, following health recommendations from … Continued

I have sat with hundreds of employers that want to make a difference. They want to make a difference in how their teams work, how productive the employees are, and better yet…in how they, as an employer, can attract, retain and engage the best and br…