Determining Minimum Value and Affordability

The IRS has released final regulations that address how wellness incentives or penalties, contributions to a health reimbursement arrangement, and employer contributions to a Section 125 plan are applied to determine affordability. While these regulations were issued in connection with the individual shared responsibility requirement (also called the individual mandate), the agencies said that they expect to use the same approach when determining affordability for purposes of eligibility for the premium tax credit and the employer-shared responsibility/play or pay requirements.

The IRS has released final regulations that address how wellness incentives or penalties, contributions to a health reimbursement arrangement, and employer contributions to a Section 125 plan are applied to determine affordability. While these regulations were issued in connection with the individual shared responsibility requirement (also called the individual mandate), the agencies said that they expect to use the same approach when determining affordability for purposes of eligibility for the premium tax credit and the employer-shared responsibility/play or pay requirements.

The regulations provide that when deciding if the employee’s share of the premium is affordable:

- Wellness incentives or surcharges, except for a non-smoking incentive, may not be considered. In other words, the premium for non-smokers will be used to determine affordability (even for smokers). Any other type of wellness incentive must be disregarded, even if the employee has earned one.

- If an employer makes contributions to a health reimbursement arrangement (HRA) that the employee may use to pay premiums, the employee’s cost of coverage may be reduced by the employer’s current year contribution to the HRA, provided that the planned employer contribution is publicized before the enrollment deadline.

- If an employer makes flex contributions through a Section 125 cafeteria plan, the employee’s required contribution may be reduced by flex contributions that (1) may not be taken as a taxable benefit, (2) may be used to pay for minimum essential coverage, and (3) may only be used to pay for medical care.

Because an employer’s contribution to a health savings account (HSA) generally may not be used to pay premiums, employer contributions to an HSA may not be used when determining affordability. For a complete checklist, download UBA’s PPACA Advisor, “Preparing for 2015 – Key PPACA Requirements”.

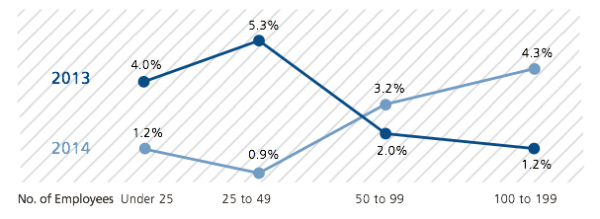

While wellness programs have increased in popularity, according to the 2014 UBA Health Plan Survey, actual wellness program adoption has been in a holding pattern. As one might expect, the highest percentage (58.8%) of plans offering wellness benefits came from employers with 1,000 or more employees and the lowest percentage (8%) of plans offering wellness benefits came from employers with fewer than 25 employees. On average, wellness programs are down slightly by 1.3%. It’s no wonder given all the pending litigation and regulation surrounding these programs, including the fact that the health of an employee population is no longer a rating factor for smaller employers.

While wellness programs have increased in popularity, according to the 2014 UBA Health Plan Survey, actual wellness program adoption has been in a holding pattern. As one might expect, the highest percentage (58.8%) of plans offering wellness benefits came from employers with 1,000 or more employees and the lowest percentage (8%) of plans offering wellness benefits came from employers with fewer than 25 employees. On average, wellness programs are down slightly by 1.3%. It’s no wonder given all the pending litigation and regulation surrounding these programs, including the fact that the health of an employee population is no longer a rating factor for smaller employers.