By Thomas Mangan

By Thomas Mangan

CEO, United Benefit Advisors

Paul, who owns a mid-size design firm in Atlanta, Ga., wanted to recruit some new talent and had some questions about how best to highlight the health benefits his firm could offer. In his research, he looked up national averages for single employee health plan cost: the amount the employee contributed to monthly premiums.

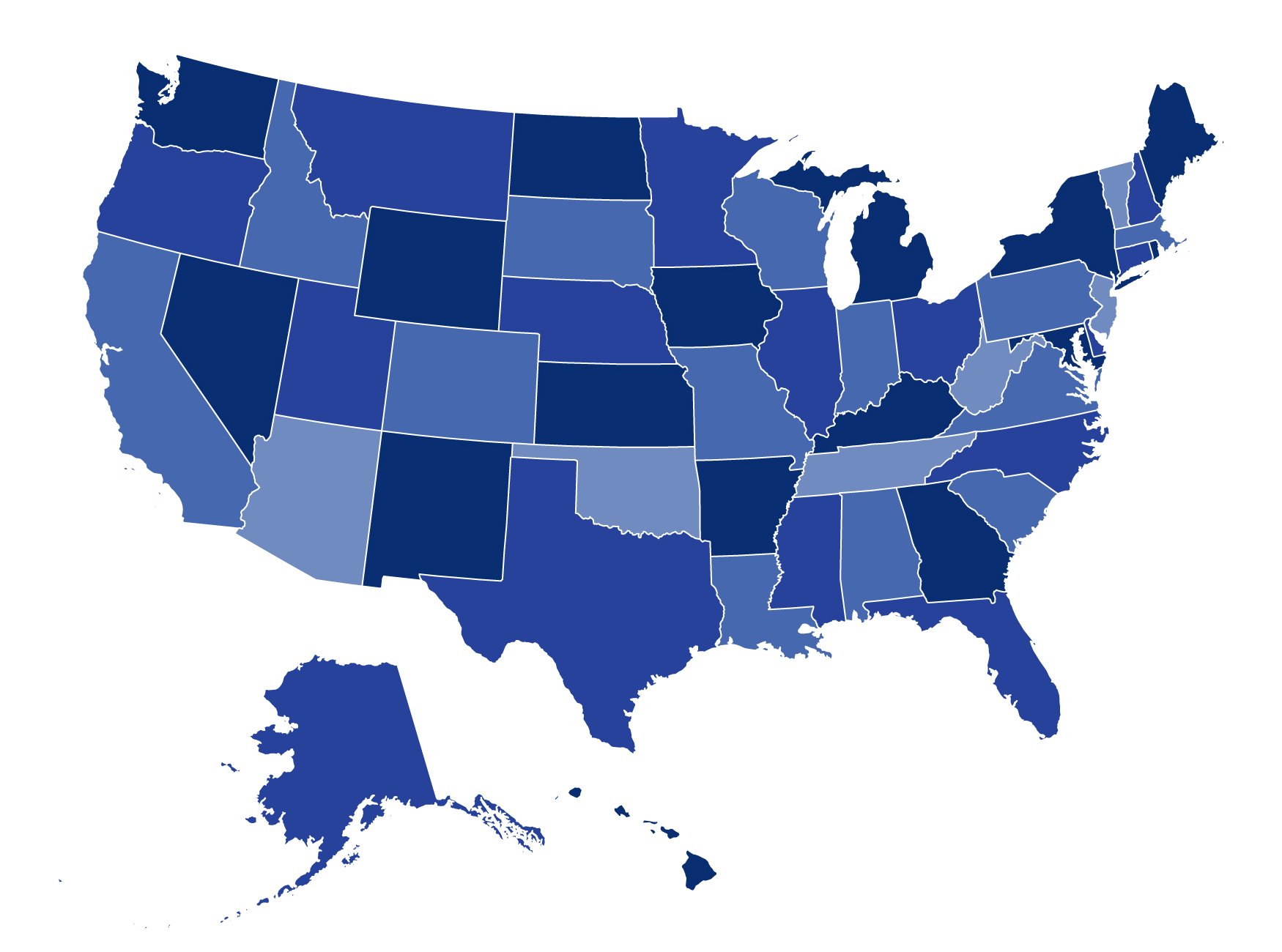

When compared against the national average for all plans, an employee at Paul’s firm pays $63 per month less, which he thought was pretty great! However, upon a closer look using more detailed benchmarking data from the 2013 UBA Health Plan Survey, he could see that when compared with other CDHPs in the Southeast region, his employee’s cost is actually $26 per month more expensive than the average.

Taking another approach, however, by comparing his employee’s cost to the closest peers using a state-specific benchmark, which in Georgia is $419, it became clear his employee’s monthly single premium is actually $10 less than competitors in the state.

Subsequently, Paul chose to highlight to potential new employees that their plan was slightly less expensive than the state average, and further emphasized all of the other great voluntary benefits his firm offers – a smart and informed strategic move.

Historically, benchmarking data of this kind were unavailable to small and mid-size employers. Now, by using such detailed information, employers are able to more accurately evaluate costs, and ultimately gain a competitive edge in recruiting and retaining a superior workforce.

Download a copy of the 2013 UBA Health Plan Survey Executive Summary or request a customized benchmarking report from a UBA Partner Firm.