By Peter Freska

Benefits Advisor at The LBL Group

A UBA Partner Firm

Employee Benefit News published an article titled, “Employers procrastinating on ACA recordkeeping compliance.” It is an interesting read, as it refers to a recent survey by PricewaterhouseCoopers in which “Only 10% of some 480 employers in 36 industries responding to a recent poll have implemented an in-house or outsourced solution to comply with Affordable Care Act reporting requirements.” This is an alarming number, as employers may be subject to significant penalties for non-compliance.

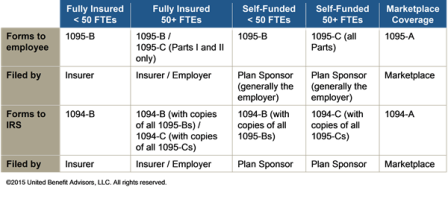

To address these concerns, United Benefit Advisor (UBA) Partner Firms, such as The LBL Group, are working with our strategic partners to provide employers with solutions. Employers will need to address the following reporting requirements:

Our solutions include both stand-alone and integrated tracking, measurement and filing systems so that employers affiliated with UBA Partner Firms can choose the solution that best fits their needs, rather than the needs of the service provider. In addition, our national compliance team continues to monitor and educate our partners on the latest developments, as they happen. These PPACA updates are available to the more than 17,000 plan sponsors working with trusted advisors from UBA.

In essence, employers are working with multiple data sources, systems, and people. For large and small employers this can be a daunting task. Education, understanding, services and systems, are all great, but having an advisor from a UBA Partner Firm on your team can make all the difference in how employers choose to move forward in complying with the laws of the land.

For comprehensive information on PPACA reporting requirements including coverage requirements, due dates, special circumstances, controlled groups and how to complete the forms – including sample situations – request UBA’s PPACA Advisor, “IRS Issues Final Forms and Instructions for Employer and Individual Shared Responsibility Reporting Forms”.