By Mick Constantinou, Advisor, Employee Benefits

By Mick Constantinou, Advisor, Employee Benefits

Connelly, Carlisle, Fields, & Nichols, A UBA Partner Firm

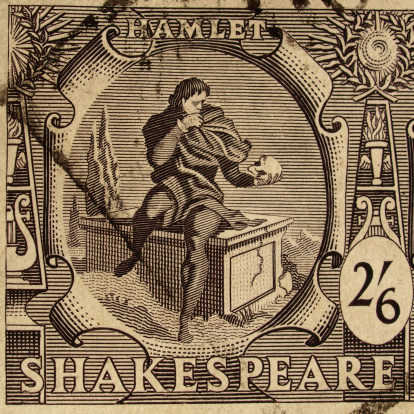

“To be, or not to be,” is the famous opening phrase of the soliloquy in William Shakespeare’s tragic play Hamlet (Act 3, Scene 1). Early in the scene, Hamlet questions the meaning of life, and whether or not it is worthwhile to stay alive when life contains so many hardships.

Many small business owners may be reciting a similar dialogue:

“To early renew, or not early renew: that is the question:

Whether ’tis nobler in the mind to suffer

The slings and arrows of healthcare reform in 2014,

Or to take arms against a sea of troubles,

And by opposing end them?”

Depending on the state, many small group carriers are offering early renewal incentives in 2013 as a way to secure their member base going into 2014. Early renewals in 2013 enable a small group to delay the impact of the small group premium cost-drivers of health care reform:

- Essential Health Benefits (10 required coverage categories)

- Out-of-Pocket Maximum (New accumulation rules and ceiling)

- Small group deductible ceiling (2,000 single / $4,000 family)

- Limited to “Metallic” coverage levels (Bronze, Silver, Gold, Platinum)

Sounds good on the surface, but small group employers should be working with a trusted advisor to take a deeper dive into this option with the carriers. New small group underwriting standards that go into effect in 2014 may actually benefit some small groups depending on their demographics.

The new underwriting standards for 2014 mean no medical underwriting and adjusted community rating (ACR). Additional rating factors (rate compression) being eliminated or changed include:

- Size factors (eliminated)

- Gender differentiation (eliminated)

- Typically 10-1 age slope (changed / reduced)

This means a relatively healthy small group with favorable demographics (younger population) may benefit from an early renewal strategy, while a less healthy and/or older population may be better served to wait until their 2014 renewal when rate compression occurs.

The consulting firm, Milliman, has projected health insurance premiums to rise by 40 percent under the Patient Protection and Affordable Care Act. Small business owners that work with a trusted advisor will have a firm perspective on best approach for their bottom line and the welfare of their workforce.

To early renew, or not early renew: that is the question.